PAYROLL INFORMATION

DESCRIPTION: Payroll Information allows you to enter the information for a payroll cycle.

It is important to note that you must fill out the Payroll Information window BEFORE you begin posting the next pay period's timecards. If this step is skipped, the Payroll Post and Import Timecards menu items will not allow you to post any payroll entries to the next pay period.

To access: Click on the Payroll module .png) then click the Payroll Information menu item.

then click the Payroll Information menu item. ![]()

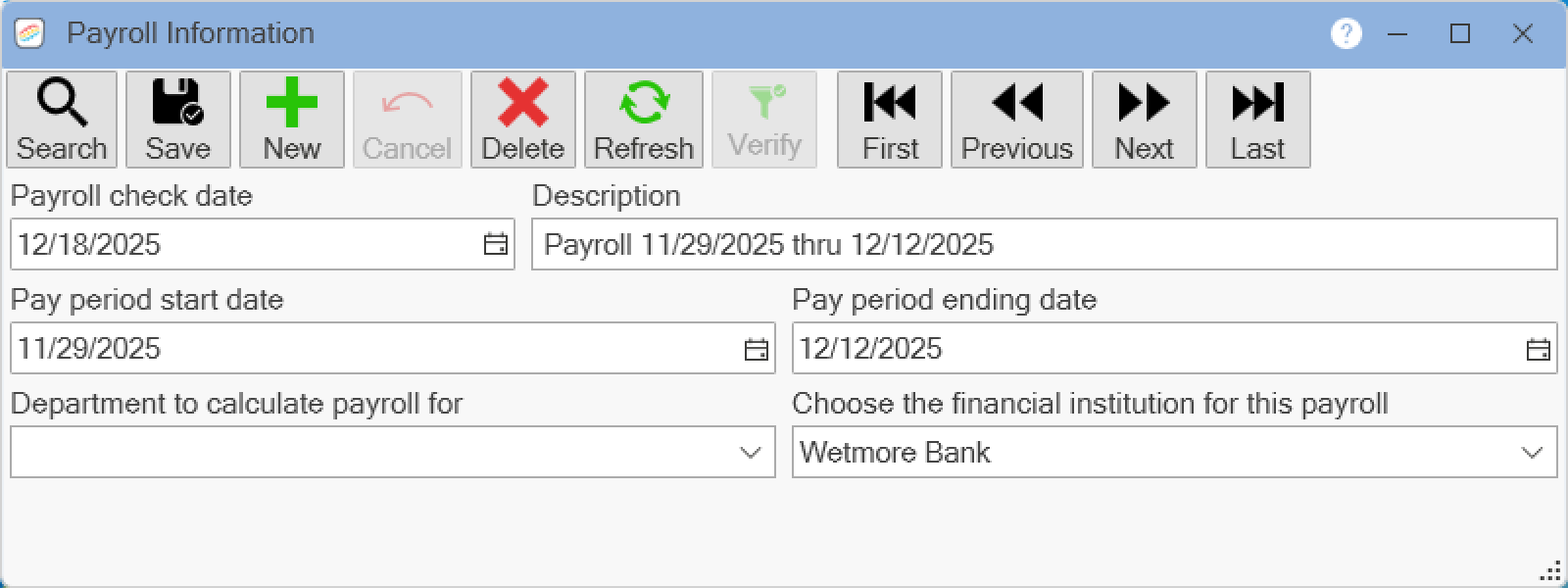

The following windows will appear:

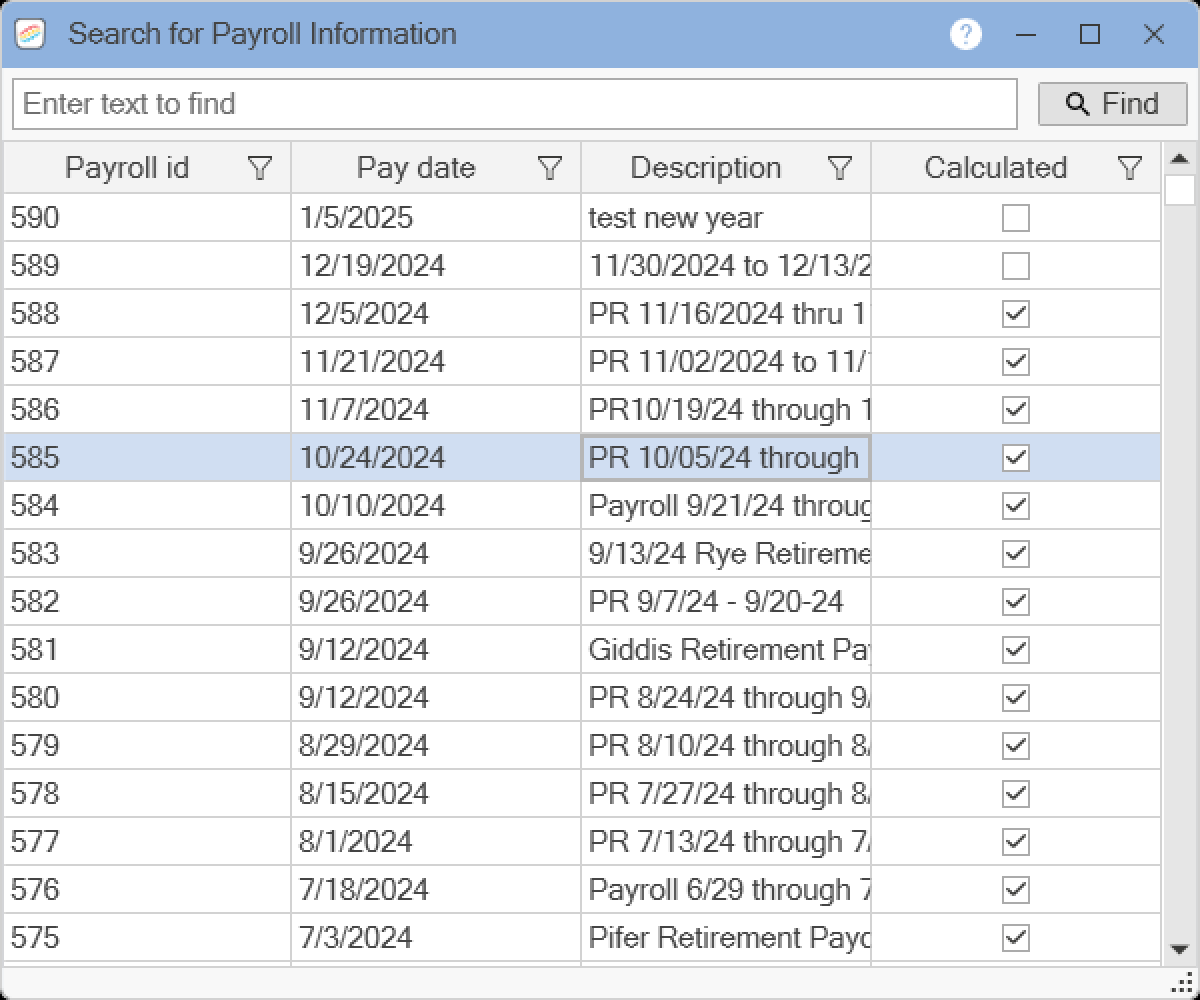

Please see the following topic for help on setting up filters ![]() in the search grid: Exploring Grid Filters

in the search grid: Exploring Grid Filters

At the top of the window there is a tool bar which contains common functions for each employee. The tool bar buttons have hot key functionality, and you can see the key combination for each button by hovering your cursor over the button.

The following is a list of the hot key combinations:

Search: Alt-E

Save: Alt-S

Add New: Alt-N

Cancel Add: Alt-C

Delete: Alt-D

Refresh: Alt-R

First: Alt-HOME

Previous: Alt-LEFT Arrow

Next: Alt-RIGHT Arrow

Last: Alt-END

Click the New button ![]() at the top of the window.

at the top of the window.

Enter the Payroll check date, which can also be entered using the calendar button. This is the date that the payroll will be issued.

NOTE: You may use the same pay date for overlapping or special payrolls if you wish. However, please realize that the EFTPS and Tax Summary reports will show information from both payrolls and not just a single payroll. Also, the Payroll Journal YTD information may be different between the two payroll journals because one payroll was posted and calculated before the other payroll.

Enter a Description for this payroll cycle. (It is a good idea to keep your regular payrolls with the same description but different dates. Then when you have a special payroll, you can give it a distinctive title so it stands out.)

Enter the starting and ending earnings dates into the Pay period start date and Pay period ending date fields. The calendar button can be used to enter in these dates. If you are entering a special payroll, for example longevity pay, you can make the pay period start and ending dates the same.

In the Department to calculate payroll for field, select the specific department for this payroll cycle by using the drop down list. Select the blank line for all departments.

By using the drop down list, Choose the financial institution for this payroll cycle.

WARNING: You may not change any of the fields for an existing payroll information record that already has been calculated (the Calculated column will be checked).

When you are finished, click the Save ![]() button. A success message window will appear. Click OK.

button. A success message window will appear. Click OK.

There may be occasions when you need to process more than one payroll within the dates of your payroll period. These may be necessary when you are paying out retirement or longevity checks, or if you pay some employees on the first and fifteenth of the month and others only on the first of the month, which would cause an overlapping of the payrolls on the first of the month. These special or overlapping payrolls must be designated by their own Payroll ID numbers and are assigned by the Payroll Information menu item. Note: A payroll period may consist of a single day.

Click on the X in the upper right corner of the window to close the window.