STATE TRUNKLINE UPDATE

DESCRIPTION: State Trunkline Update processes all the data for the current period to produce a billing file that can be sent to the Michigan Department of Transportation (MDOT).

To access: Click on the General Ledger module .png) then click the State Trunkline Update menu item.

then click the State Trunkline Update menu item. ![]()

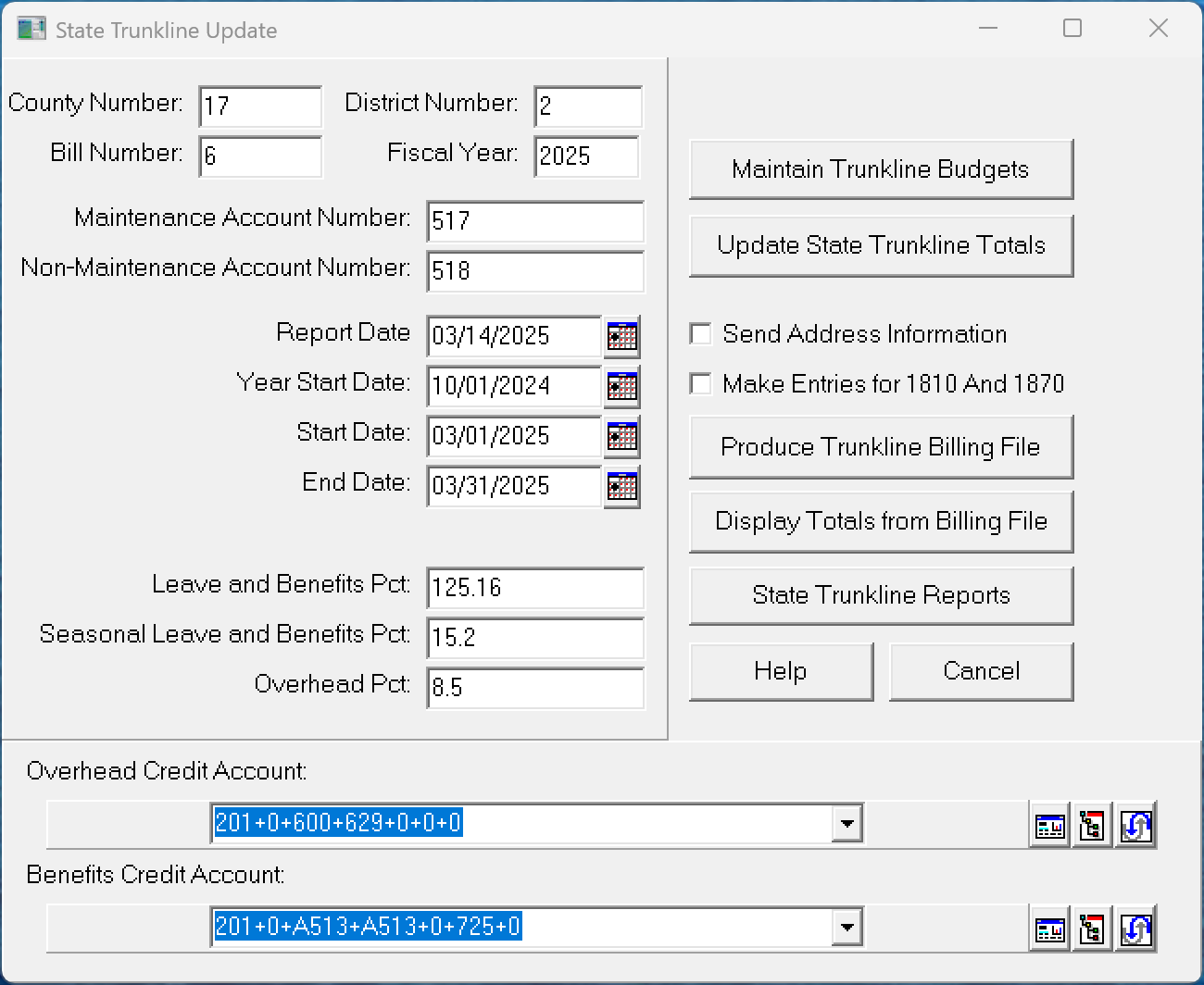

The following window will appear:

Enter your County Number and optional District Number. These numbers are provided by MDOT. Enter the Bill Number you are producing for the state and the MDOT Fiscal Year. The Bill Number is not the same as the month, it starts with a 1 in October each year. Specify the appropriate Maintenance Account Number and the Non-Maintenance Account Number fields. Usually these are 517 and 518 or A517 and A518 (which is a level 3 account number). Enter the Report Date and the start date of the MDOT fiscal year into the Year State Date field by either typing in the date or by using the Calendar button. This is the date you want printed on the report. Also enter the Start Date and the End Date of the current billing period. Enter your percentages for the Leave and Benefits, the Seasonal Leave and Benefits, and the Overhead. These are provided by Act 51. For example, 60% is entered as 60 or 60.0 and 25.3% is entered as 25.3.

The Overhead and Benefits Credit Account numbers are automatically filled in and cannot be changed. If your address has changed and needs to be updated with the state, check the Send Address Information box. This will include the latest address in the billing file so it will be updated. This should normally be unchecked. There is also an option to make entries for the Benefits and Overhead for each trunkline contract. If you need these entries to be made, then check the Make Entries for 1810 And 1870.

After filling in the information, click the Update State Trunkline Totals button to process all the data for the current period. As the data is being processed, error messages may appear indicating data is missing or incorrect. If an error message appears, make a note of what it is and click OK to continue. Once the process is finished, the totals will show. Click OK. If there were any errors, correct them and click the Update State Trunkline Totals button to process the data again. This process can be run as many times as needed until no errors are found. You can also inspect the totals for any activity by clicking the Maintain Trunkline Budgets button.

After successfully updating State Trunkline Totals, create the State Trunkline Billing file by clicking the Produce Trunkline Billing File button. This will process data in the same way as the Update State Trunkline Totals and then produce the State Trunkline Billing file to submit to MDOT. The file name is broken down as follows: your 2-digit county number, the 2-digit month, the 2-digit year, a period ("."), and the bill number. This will also create a transfer voucher journal that contains entries for the Benefits and Overhead, if you selected the option to make those entries. You will be prompted to Name and Save your Billing file. When the process is finished, the totals will show. Click OK. If a transfer voucher journal was created for Benefits and Overhead, a confirmation window will show the journal information. If errors occurred during the process, fix them, and then produce a new Trunkline Billing file. This process can also be run as many times as needed. If a bill file already exists, you will receive a warning. The Display Totals from Billing File button can be used after creating your Billing file to display the totals from the newly produced file in order to verify that it was created correctly. When viewing the totals, check the file name at the top to make sure it is the correct file.

If you need to view or update any of the State Trunkline Budget items, the Maintain Trunkline Budgets button will open the State Trunkline Budget menu item. If you wish to print additional State Trunkline reports, click the State Trunkline Reports button. These reports get most of their parameter information from the information entered on the State Trunkline Update window so it will fill in automatically.

Possible Trunkline Error Messages:

There are several conditions that may be encountered while producing the reports. These may occur while processing the Update State Trunkline Totals or by the Produce Trunkline Billing File. In all cases you should correct the error condition and try the function again.

Error, the Account 201-0-A517-x-y-z does not have a GLAcct entry, assuming Bill Type of M (Maintenance). Each transaction must be classified as to its Bill Type. Valid Bill Types are ‘M’, ‘T’, ’G’, ‘N’, ‘L’, or ‘R’. These are validated against the 7-level account number in the General Ledger module and the Accounts menu item. The proper letter must be entered in the Misc field. If it is incorrect, Pro Fund Accounting assumes that the Bill Type is ‘M’ and continues.

Error, the Employee xyz does not exist. The Trunkline Bill file may not be valid. A Payroll transaction has been encountered that has an invalid Employee. Find and fix the transaction (in SOE PR) or set up the employee by clicking the Payroll module and selecting the Employees menu item. Processing will continue, but the created billing file will be incorrect.

Error, the Account 201-0-A517-x-y does not have a General Ledger Account entry. The Trunkline Bill file may not be valid. This 5-level account number on a transaction does not exist in the Accounts menu item. Click the General Ledger module and select the Accounts menu item, and set it up. This error is found when looking for a four digit LARS code. The code is unique to each Road Commission and is supplied by MDOT.

Click on the X in the upper right corner of the window or click the Cancel button to close the window.