THIRD PARTY PAY

DESCRIPTION: If your employees receive sick pay from a third party (e.g., an insurance company) and those companies issue you statements showing the amounts paid to your employees, you will need to make entries for the pay they have received from the third parties. This pay will then show up in the correct box on their W-2 at the end of the year.

=================================================================

1.To access the Third Party Pay program, click on the Payroll button, .png) , then click on the THIRD PARTY PAY button.

, then click on the THIRD PARTY PAY button.

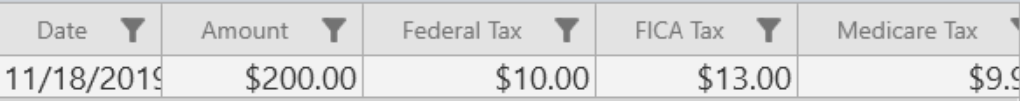

The following screen will appear:.png)

Please see the following topic for help on setting up filters in the third party pay grid: Exploring Grid Filters

2.Highlight an employee from the Employees list

3.Click the Click here to add a new row button to start a new line entry

4.Enter all the pertinent information according to how the employee was paid, if applicable. Effective Date, Pay Amount, Federal Withholding, FICA Withholding, Medicare Withholding, the State Code, State Withholding, City Code, City Withholding.

5.Once all the information is entered, tab or move off of the current row in the Third party pay transactions grid or click to another employee to save the changes made to the third party transactions.

The Third party pay transactions grid allows for adding new records and editing existing records. Most changes should be saved automatically when the focus leaves the current cell.