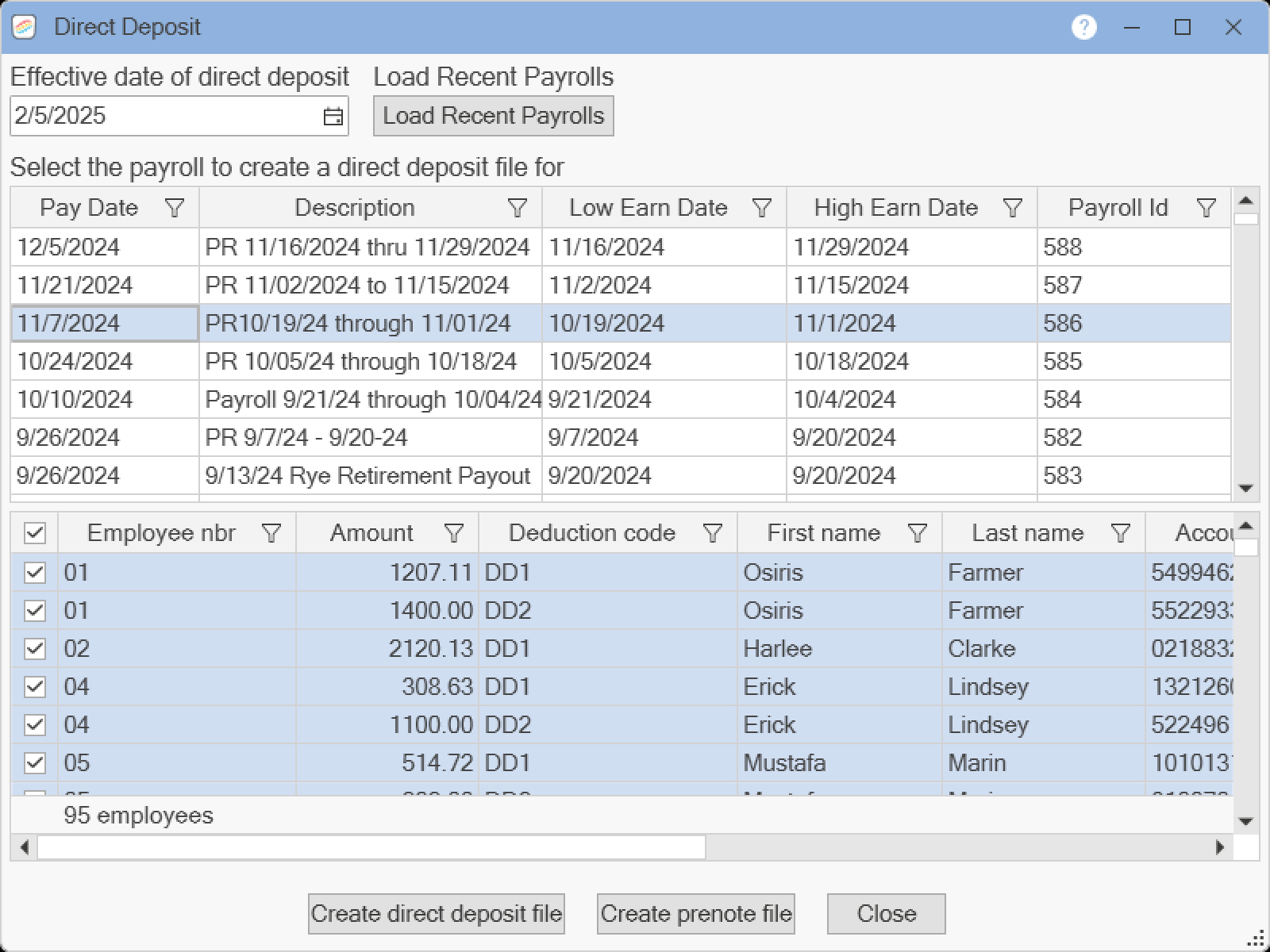

FINANCIAL INSTITUTIONS

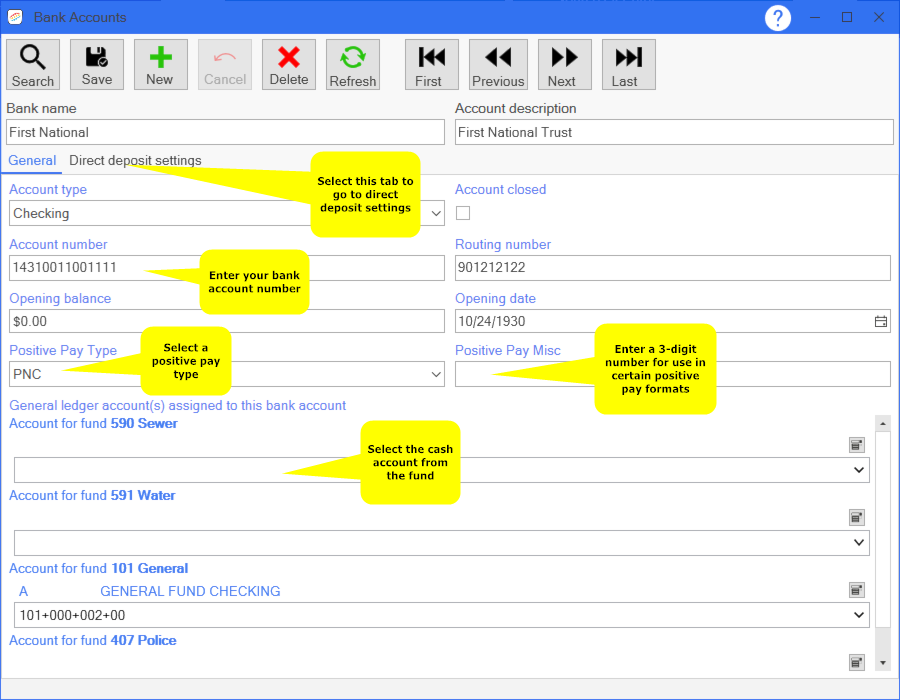

Description: Pro Fund Accounting's Bank Accounts is used to mange your financial institution information. Pro Fund Accounting uses this financial information in our positive pay, payroll calculation, bank reconciliation, payables calculation, make deposits, and direct deposit functions.

Setup Required: In your chart of accounts a cash account is required for each fund the bank will be using. You can set this up by going to Account Maintenance.

Setting up a bank account: To setup a bank account, go to the General Ledger module and select Bank Accounts. Click the New button, then enter the bank's name and account description. Pro Fund Accounting recommends these two are the same. Enter the type of account, account number, and routing number. When you are finished setting up the bank account, click on the Save button at the top of the screen. In Pro Fund Accounting, a single bank account can manage the activities for an unlimited number of funds. Enter the chart of accounts cash account from all the funds that are using this bank. Pro fund accounting allows a single fund to have many bank accounts manage its activities. Each of those bank accounts will need a separate account number within the fund.

Once the bank account has been created and saved successfully, you can use Pro Fund Accounting's Bank Account features. The bank account can be configured for both positive pay and or bank reconciliation.

Configuring Positive Pay: To configure a bank account for positive pay, select which positive pay type the financial institution requires. If your positive pay type requires any additional information, enter it in the Positive Pay Misc field.

Configuring Direct Deposit: To set up direct deposit, click the Direct deposit settings tab and follow the instructions provided Here.

Once you select the Bank Accounts menu item, the following window will appear:

Pro fund Accounting Direct deposit settings tab has the field titles matching the ACH format titles. your financial institution should be able to provide the information they require for the direct deposit batch and file header. in the window below, we show maximum number of characters that each field can contain. Not all fields are required to have a value. The ACH other settings check boxes provide options to the ACH file layout. The credit entry will add a record at the end of the file that has the total of all the individual transactions in the file. The ACH blocking record is a way to indicate the last record in the file is all 9's.

Once you select the Direct deposits settings tab, the following window will appear: